In the world of finance and investments, ensuring the security of loans and credit facilities is paramount. One of the ways lenders secure their interests is through pledge agreements, particularly involving shares or stock. This comprehensive guide delves into pledge agreement templates for shares or stocks, providing insights into their importance, key components, and practical tips for drafting effective agreements.

What is a Pledge Agreement?

A pledge agreement is a legal contract where a borrower pledges assets to a lender as collateral to secure a loan. In the context of shares or stock, the borrower (or pledgor) pledges their shares in a company to the lender (or pledgee) to secure the repayment of a debt. If the borrower defaults, the lender has the right to sell the pledged shares to recoup the owed amount.

Importance of Pledge Agreements for Shares or Stock

- Security for Lenders: Pledge agreements provide a safety net for lenders. By securing a loan with shares or stock, lenders have a tangible asset they can liquidate if the borrower defaults.

- Access to Financing for Borrowers: For borrowers, pledging shares can be a way to access financing without having to sell their assets. This can be particularly advantageous for business owners who do not want to dilute their ownership in the company.

- Clarity and Legal Protection: Well-drafted pledge agreements ensure that both parties understand their rights and obligations, minimizing potential disputes and legal complications.

Key Components of a Pledge Agreement Template for Shares or Stock

A robust pledge agreement template should include the following key components:

- Parties Involved:

- Pledgor: The individual or entity pledging the shares.

- Pledgee: The individual or entity receiving the pledge as collateral.

- Recitals:

- A section outlining the background and purpose of the agreement. This typically includes references to the loan or credit facility being secured by the pledged shares.

- Description of Pledged Shares:

- A detailed description of the shares being pledged, including the number of shares, the company they belong to, and any relevant stock certificates or identification numbers.

- Secured Obligations:

- A clear definition of the obligations being secured by the pledge, including the amount of the loan, interest rates, and repayment terms.

- Pledgor’s Representations and Warranties:

- Statements confirming that the pledgor has the right to pledge the shares and that there are no existing encumbrances or claims against them.

- Pledgee’s Rights and Remedies:

- Provisions outlining the pledgee’s rights in the event of default, including the right to sell the pledged shares and apply the proceeds to the outstanding debt.

- Voting Rights and Dividends:

- Clauses specifying how voting rights and dividends associated with the pledged shares will be handled during the term of the pledge.

- Covenants:

- Ongoing obligations of the pledgor, such as maintaining the value of the pledged shares and not encumbering them further.

- Default and Enforcement:

- Detailed procedures for what constitutes a default and the steps the pledgee can take to enforce their rights.

- Governing Law and Jurisdiction:

- The legal jurisdiction governing the agreement and any dispute resolution mechanisms.

- Miscellaneous Provisions:

- Additional clauses, such as amendments, notices, and counterparts, ensure the agreement is comprehensive and enforceable.

Free Pledge Agreement Templates for Shares or Stock

Here is my selection of Top Free Pledge Agreement Templates for Shares or Stock to assist you fully.

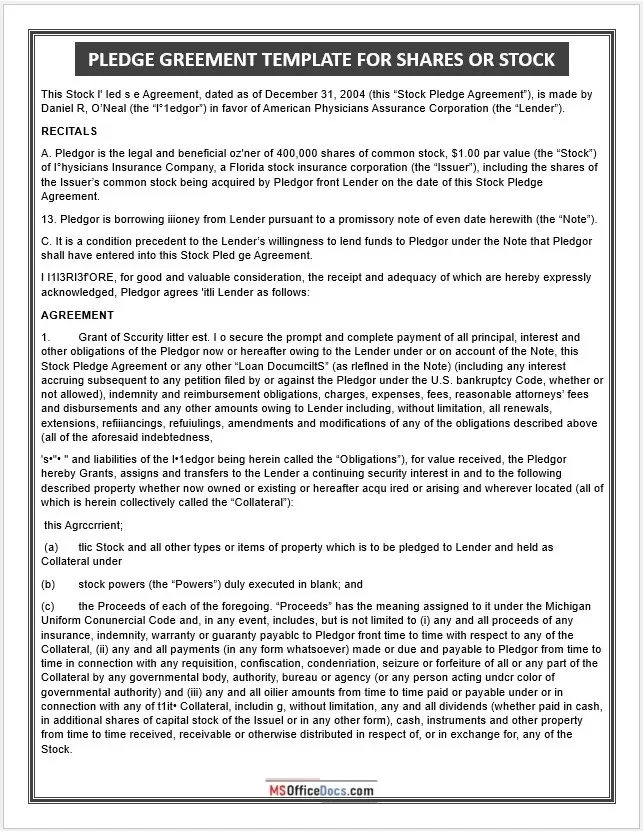

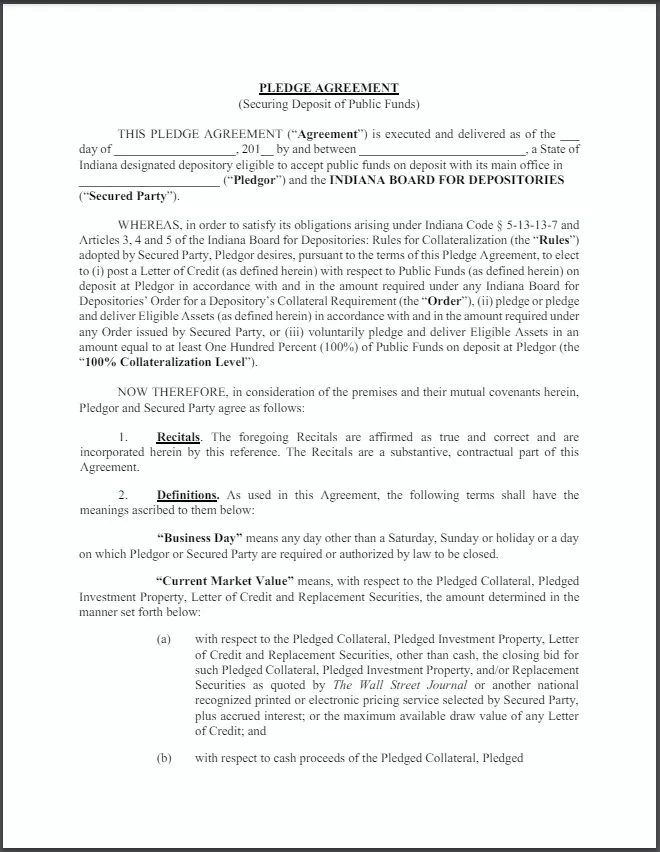

***** Template Rated 1st *****

Source: msofficedocs.com

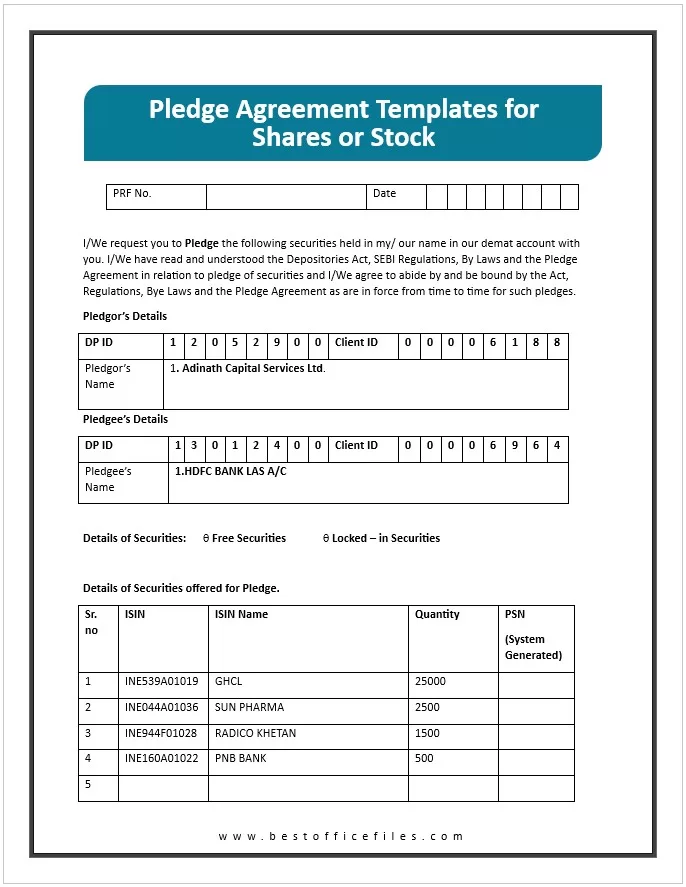

**** Template Rated 2nd ****

Source: bestofficefiles.com

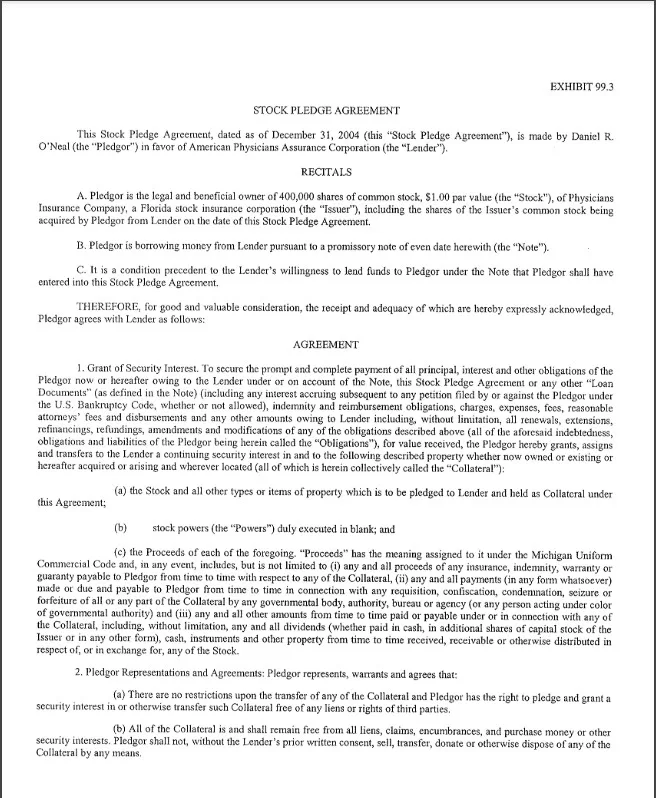

**** Template Rated 3rd ****

Source: oci.wi.gov

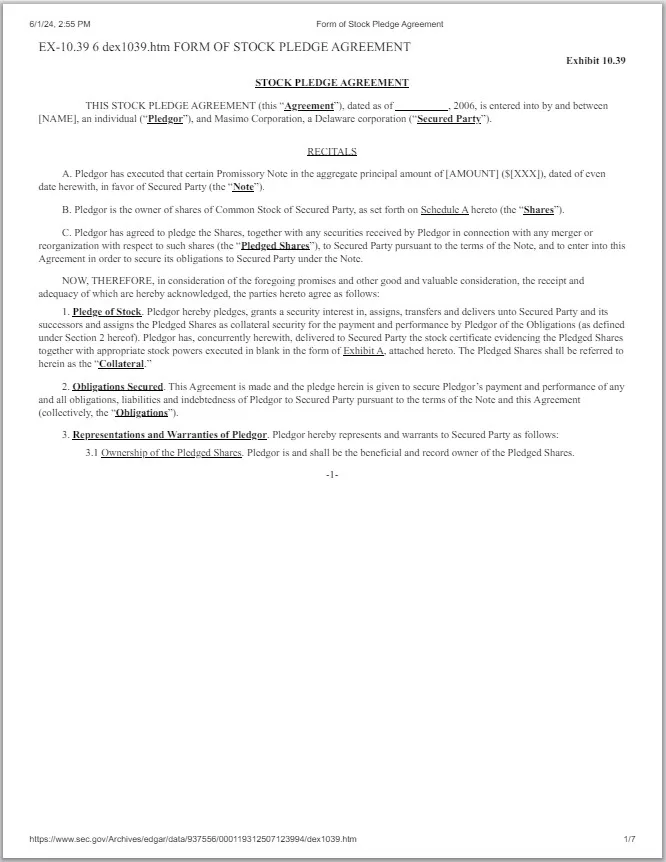

**** Template Rated 4th ****

Source: sec.gov

**** Template Rated 5th ****

Source: in.gov

Crafting an Effective Pledge Agreement Template

When drafting a pledge agreement template for shares or stock, several best practices can help ensure the document is clear, enforceable, and tailored to the specific needs of the parties involved.

- Use Clear and Precise Language:

- Avoid ambiguous terms and ensure that all provisions are written clearly and straightforwardly. This helps prevent misunderstandings and disputes down the line.

- Customize to Specific Needs:

- While templates provide a good starting point, it is crucial to tailor the agreement to the specific transaction. This includes customizing the description of the pledged shares, the secured obligations, and any unique terms agreed upon by the parties.

- Consult Legal Experts:

- Given the legal complexities involved in pledge agreements, it is advisable to consult with legal professionals who specialize in securities and financial transactions. They can help ensure the agreement complies with relevant laws and regulations.

- Incorporate Comprehensive Default Provisions:

- Clearly define what constitutes a default and outline the procedures the pledgee can follow to enforce their rights. This includes specifying the notice period, the method of sale of the pledged shares, and how the proceeds will be applied.

- Address Voting Rights and Dividends:

- Clarify how voting rights and dividends will be handled during the term of the pledge. Typically, the pledgor retains these rights unless a default occurs, but the specifics should be clearly outlined in the agreement.

- Include Representations and Warranties:

- Ensure that the pledgor provides representations and warranties about their ownership of the shares, their authority to pledge them, and the absence of any other encumbrances. This protects the pledgee and provides recourse if the pledgor’s statements are false.

Practical Examples of Pledge Agreement Provisions

To illustrate, here are some practical examples of key provisions in a pledge agreement for shares or stock:

Description of Pledged Shares

“The Pledgor hereby pledges and grants a security interest in the following shares to the Pledgee: [Number] shares of common stock of [Company Name], represented by stock certificate number [Certificate Number].”

Secured Obligations

“This pledge secures the prompt and complete repayment of all obligations of the Pledgor under the loan agreement dated [Date], including the principal amount of $[Loan Amount], interest, fees, and any other amounts payable by the Pledgor.”

Default and Remedies

“Upon the occurrence of a default, the Pledgee shall have the right to sell the pledged shares at a public or private sale. The Pledgee shall provide the Pledgor with [Number] days’ written notice of the sale. The proceeds from the sale shall be applied to the secured obligations, with any excess returned to the Pledgor.”

Voting Rights and Dividends

“During the term of this pledge, the Pledgor shall retain all voting rights and rights to dividends associated with the pledged shares, unless and until a default occurs. Upon default, the Pledgee shall have the right to exercise all voting rights and to receive any dividends.”

Pledge agreements for shares or stocks play a critical role in securing loans and credit facilities, offering protection for lenders and financing opportunities for borrowers. A well-drafted pledge agreement template ensures clarity, legal protection, and enforceability. By incorporating clear language, customized provisions, and comprehensive default clauses, parties can create effective pledge agreements that meet their specific needs. Consulting legal experts and addressing key aspects such as voting rights and dividends further strengthens the agreement, providing a robust framework for securing financial transactions. Whether you are a lender or a borrower, understanding and utilizing pledge agreement templates for shares or stock is essential for navigating the complex world of financial securities.

Jim Karter is a seasoned blogger with a profound interest in the intricacies of office document processes. With years of experience in the field, Jim has dedicated his career to helping individuals and businesses streamline their daily tasks through the use of efficient and practical templates. His passion for organization and productivity shines through in every piece of content he creates.